FMI Sees 18 More Months Of Strong Growth

by ROB McMANAMY | Feb 12, 2016

Last month, less than a week after Goldman Sachs announced that it would pay $5.1 billion to settle all government claims against it stemming from Wall Street's financial meltdown in late 2008, I asked FMI principal Rusty Sherwood about the widespread fraudulent shenanigans maddeningly depicted in the recent holiday release, The Big Short. Could that 'perfect storm' all happen again?

FMI's Sherwood

"Great question," said Sherwood, in town from Denver to deliver an annual national forecast and market overview speech to a packed monthly luncheon meeting of the Chicago Building Congress (CBC). "I'm not the best person at FMI to answer that, but I would like to think that we are all a lot smarter now than we were then, and that we are acting accordingly in the here and now. Could we be smarter? Definitely."

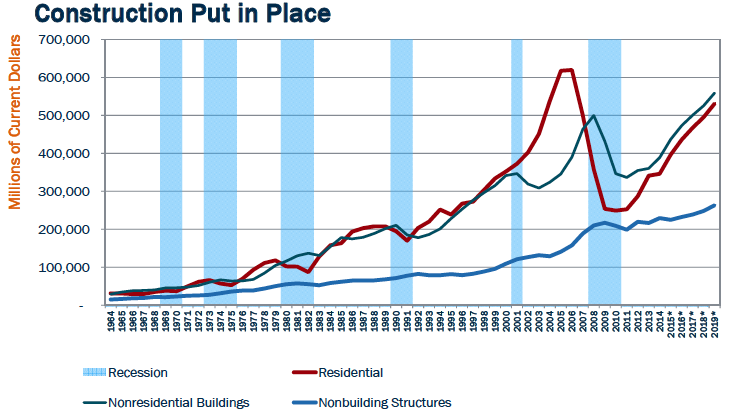

Keeping that in mind, Sherwood's overall message was encouraging about the AEC industry's economic prospects, in Chicago and across the U.S., at least through the middle of 2017. Our extended recovery from the Great Recession is "at the 78-month stage now of what we anticipate is a 95-month cycle," he told the 300-plus attendees. "So, we still have some runway left. The near-term forecast looks good for just about all types of construction, and as a result, we see the recovery strengthening for at least the next 18 months."

- 50 Plus: FMI data from 1964 through 2019. Blue columns represent recessions. Are we due?

Recognizing that his speech was a bit late in the season for a pure forecast format, he noted afterward that he intended it to be broader, to deliver a "business cultural strategy."

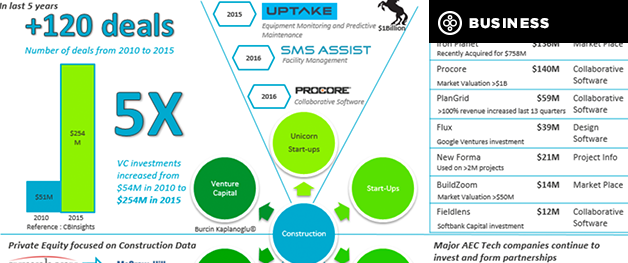

Toward that end, Sherwood touched on many business and demographic trends that he feels sure will have a profound impact on our industry, from earth-shaking advances in technology to next-generation recruitment and issues of company ownership and leadership succession. And now all also have to be considered against a small-world backdrop of VUCA. "World influences today impact us daily, so 'VUCA' is our new norm," he explained.

"Disruption is accelerating, so productivity and efficiency are really going to have to ratchet up in our industry to keep pace," said Sherwood. "For example, drones can be and will be used to eliminate wasted time in performing tasks like helping to properly position cranes on jobsites... Beyond our industry, businesses such as body shops may suffer. Why? Because autonomous vehicles will have fewer accidents than humans!"

Learn more about P3s here next week!

Given the sorry state of much U.S. infrastructure, the demand for related transportation, water and energy projects should also remain strong indefinitely. What is not certain, however, is the level of public funding that will be available for such work. "P3s are important now," he noted, referring to public-private partnerships being used on projects like design and construction of New York's new multi-billion-dollar LaGuardia Airport.

"Sure, some folks have had some problems with P3 delivery in some areas, but there is just so much infrastructure that needs to be rebuilt now that it will still have a major role to play," Sherwood predicted.

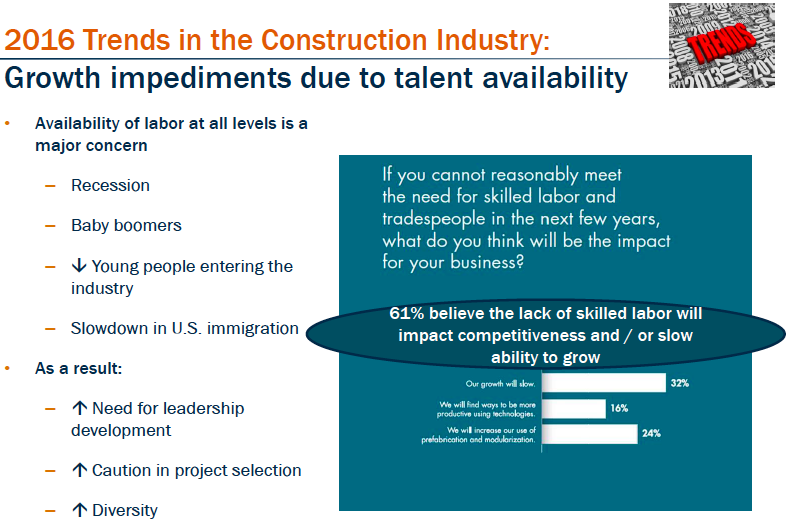

Meeting all that demand will require manpower, and lots of it, even with technology stepping up to help in many areas. "There is and will be a talent impediment," he added. "A recent survey found that 61% of responding (managers) believe that a lack of skilled labor will impact their competitiveness, and slow their ability to grow."

Source: FMI

Meanwhile, as the industry grows younger, leadership succession issues also are intensifying. "Seven out of 10 senior executives in construction are baby boomers, so the majority of managers will retire in five to seven years," Sherwood noted. "By 2030, millennials will outnumber boomers by 22 million."

With that in mind, increased and even jazzier recruitment efforts toward the next generation will need to be launched as soon as possible. "The best and the brightest have a lot of options to choose from now," he observed. "Paychecks still matter, of course, but millennials are looking for something that goes beyond the bottom line."

Luckily, this industry seems to offer that magic lure of real opportunities to affect meaningful change.

"I have a millennial son-in-law in Denver who is an electrical engineer," Sherwood told the CBC crowd. "I asked him, 'Why did you choose this industry?' He said, 'Because there is so much upside for change in it today, just so much opportunity.'"

Indeed, that 'upside for change' will only grow more urgent in the disruptive days to come.